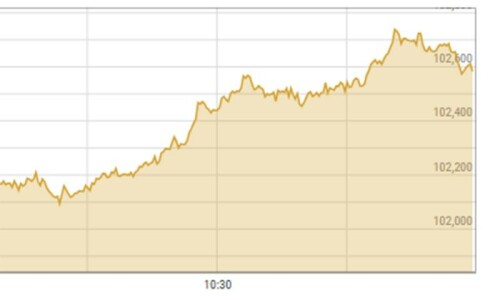

Karachi: December 2, 2024

The Pakistan Stock Exchange (PSX) continues to show positive growth, as the benchmark KSE-100 index exceeded the 100,000-point mark for the first time in history. With investors expecting a drop in inflation for November, the index surged by over 1,900 points, closing at 103,274.94. This increase is driven by expectations that lower inflation will lead to reduced interest rates, benefiting various sectors like the automotive industry, which is already witnessing growth in sales.

Experts believe that continued optimism surrounding the PSX is linked to the stabilization of Pakistan’s macroeconomic indicators, including anticipated policy adjustments aimed at controlling inflation. According to Yousuf M. Farooq, director of research at Chase Securities, falling inflation could push interest rates into single digits, potentially enhancing stock market valuations.

In the coming months, retail investors are advised to stay focused on long-term investments, particularly in government-owned companies, as these may see higher valuations. Awais Ashraf, director of research at AKD Securities, suggests that the market’s positive sentiment is also driven by structural reforms that could lead to a more stable economy. Furthermore, the upcoming Monetary Policy Committee meeting could introduce measures that will further support equity markets.