On Thursday, Huawei for the first time outlined its long-term chip plans and announced it will launch some of the world’s most powerful computing systems. This move underscores China’s push to reduce its reliance on foreign semiconductor suppliers like Nvidia.

Breaking years of secrecy about its chip business, Huawei (HWT.UL) detailed the launch timelines for its Ascend artificial intelligence (AI) chips and Kunpeng server chips. This announcement could significantly raise the stakes in the ongoing US-China rivalry for technological supremacy.

Eric Xu, Huawei’s current rotating chairman, also revealed that the company now has its own proprietary high-bandwidth memory, a technology currently dominated by South Korea’s SK Hynix and Samsung Electronics.

“We will follow a one-year release cycle and double compute with each release,” Xu stated at the annual Huawei Connect conference in Shanghai.

In recent weeks, China has intensified its efforts against Nvidia, the world’s leading AI chipmaker, while promoting its domestic chip manufacturing. On Monday, Chinese authorities accused Nvidia of violating the country’s anti-monopoly law. According to a Financial Times report and a source familiar with the matter, Chinese authorities have also ordered top tech firms to halt purchases of Nvidia’s AI chips and cancel existing orders.

Huawei’s announcement appears to be carefully timed for maximum impact ahead of a meeting between US President Donald Trump and Chinese President Xi Jinping on Friday. The meeting follows the conclusion of trade talks between US and Chinese negotiators this week.

“China is trying to say that they’re doing very well on many fronts… Xi Jinping will be more confident when speaking with Donald Trump,” said Alfred Wu, an associate professor at the National University of Singapore. “People assume that the situation is getting better, that everything is moving in the right direction, that US-China tensions will be eased to some extent but I’m thinking this is not the case; actually, it’s quietly escalating.”

Supernodes to Boost Computing Power

Huawei first announced its plans to enter the chipmaking industry in 2018. However, it ceased public discussion of these efforts after the US sanctioned it in 2019, citing national security risks—a charge the company denies. Since then, analysts say Huawei has become a leader in China’s efforts to develop a domestic semiconductor manufacturing industry.

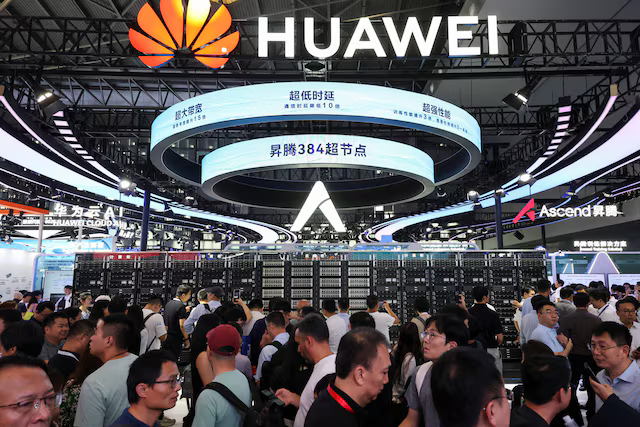

Huawei launched its latest AI chip, the Ascend 910C, in the first quarter of this year. Its successor, the Ascend 950, will be launched next year in two variants. This will be followed by the 960 version in 2027 and the 970 in 2028.

Additionally, Huawei plans to roll out new computing power supernodes that will allow chips to interconnect at high speeds. These nodes can be described as a rack system containing numerous chips, which are then grouped into clusters.

The Atlas 950, which will support 8,192 Ascend chips, is scheduled for a Q4 2026 launch. Xu expressed confidence that the Atlas 950 “will far exceed its counterparts across all major metrics.” The Atlas 960, which will support 15,488 Ascend chips, will be launched in the fourth quarter of 2027.

These supernodes are successors to the Atlas 900, also known as the CloudMatrix 384, which uses 384 of Huawei’s latest 910C chips.

“Huawei is leveraging its strengths in networking, along with China’s advantages in power supply, to aggressively push supernodes and offset lagging chip manufacturing,” said Wang Shen, a data center infrastructure practice lead at tech research firm Omdia.

New versions of Huawei’s Kunpeng server chip are also set to be launched in 2026 and 2028, Xu added.

Despite recent advances by Huawei and other Chinese chip firms, engineers at Chinese tech firms say Nvidia’s chips still perform better. The extent to which China has access to Nvidia’s world-leading chips has been a major point of friction between the two countries. The US has imposed export controls, forcing Nvidia to sell only downgraded versions of its chips, though it has recently rolled back some of its most severe restrictions.

Washington has also used export controls to prevent firms like Huawei from using advanced US chip manufacturing technology.

“For Huawei to come out at this point and openly show strength with its AI chips, I think it reflects both that domestic advanced chip manufacturing capacity is no longer such a big constraint for marketing the product, and that there’s growing confidence U.S. export controls are not really threatening this process anymore,” said Tilly Zhang, an analyst at Gavekal Dragonomics.

Shares of Chinese semiconductor firms rose 3.4% after the Financial Times reported that top Chinese tech firms were ordered to halt purchases of Nvidia AI chips.

According to one person in China’s chip distribution sector, his company recently received an oral order to stop buying from Nvidia and was told that distributors could now only sell stockpiled Nvidia AI chips. The person was not authorized to speak on the matter and declined to be identified. China’s cyberspace regulator has not yet responded to a Reuters request for comment.

When asked about the reported ban, China’s foreign ministry said that China is willing to maintain dialogue with all parties to keep global supply chains stable.