KARACHI, PAKISTAN:

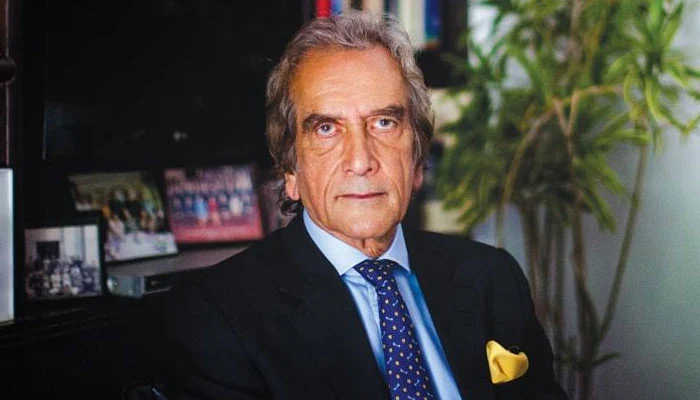

A significant and critical statement has emerged concerning Pakistan’s financial sector from Saleem Raza, the former Governor of the State Bank of Pakistan (SBP). He has publicly criticized the banking sector, arguing that the increasing profits primarily benefit investors and shareholders rather than general consumers and the broader economy.

In a statement released from Karachi, Saleem Raza highlighted the banking industry’s exceptional performance over the past year. He noted that “it was a good year for the banks,” which collectively amassed a total profit of Rs 600 billion. These figures underscore the financial sector’s considerable success.

He further added that banks continued their high profitability streak, earning Rs 325 billion in the first six months of the current year, even as the country saw a measurable reduction in overall inflation. This paradox raises a critical question: why are the benefits of reduced inflation not being passed on to consumers in the form of lower lending rates or better returns on deposits?

The former SBP Governor pointed directly to the core of the issue: “The profit of the banks is benefiting investors, not the public.” His stance is a direct critique of the prevailing high-interest-rate environment and the banking model, where high profits are generated without a corresponding benefit to ordinary citizens through favorable lending or savings rates. His statement draws attention to the social equity implications of current financial policy and the welfare of the common consumer.