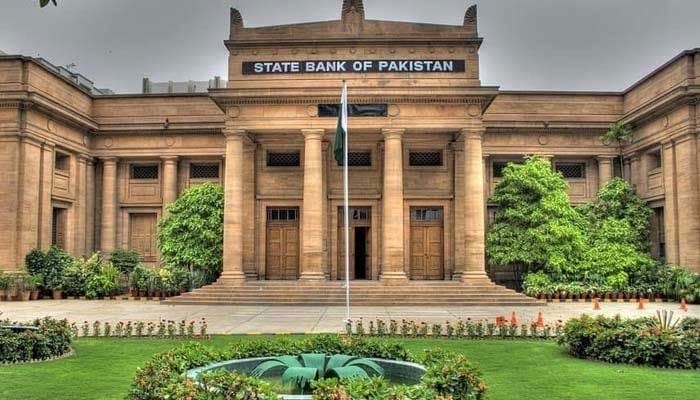

On Tuesday, the State Bank of Pakistan (SBP) informed the National Assembly Standing Committee on Finance that the country’s Gross Domestic Product (GDP) growth rate for the current fiscal year may fall below the government’s target of 4.2%.

Forecasts on GDP and Foreign Exchange Reserves

The National Assembly’s Standing Committee on Finance and Revenue held its meeting under the chairmanship of Syed Naveed Qamar at Parliament House. SBP officials informed the committee that GDP growth for FY26 might reach only 3.2% against the official target of 4.2%.

Deputy Governor of the State Bank, Dr. Inayat Hussain, told the committee that the central bank projects foreign exchange reserves to reach $15.5 billion by December and $17.5 billion by June. He warned that any artificial appreciation of the rupee would increase the import bill and further strain reserves. He added that the current value of the rupee against the dollar is at the “right level,” neither overvalued nor undervalued.

PTI MNA Usama Mela noted that in July alone, the government bought $720 million from the market. Dr. Inayat confirmed that the central bank purchased $7.8 billion from the open market during the last fiscal year, stating that the bank only intervenes when there is an excess supply of dollars.

Inflation, Remittances, and Other Economic Issues

The SBP also projected that inflation could exceed its target between April and June. Officials informed the committee that the IMF has permitted a 1.2% value gap between the rupee and the dollar.

Over the past decade, Pakistan’s GDP growth has averaged just 3%, while remittances for the current fiscal year are estimated at $40 billion. The government reinstated an incentive scheme—offering banks 20 riyals for every $200 transaction—after observing a decline in inflows.

Committee member Sharmila Faruqui questioned whether interest rates should now be lowered, given persistent inflationary pressures. The next monetary policy meeting is scheduled for September 15.

Other Key Points from the Standing Committee Meeting

During the session, Naveed Qamar strongly criticized the Ministry of Industries and Production for its absence and failure to brief the committee on the carbon levy imposed under the new electric vehicles policy. He said parliament had been misled, even during the budget session, adding that “the government thinks its job is done while parliament can go to waste.” The committee also deferred a briefing on the electric vehicles policy.

The NA panel opposed the Corporate Social Responsibility (CSR) Bill 2025 introduced by the SECP, which proposes that profit-making companies allocate 1% of their net profits to social work. Naveed Qamar argued this should be mandatory, while Minister of State Bilal Azhar Kayani objected, stating it would be a new tax. Committee members Hina Rabbani Khar and Mubeen Arif also raised concerns, with Dr. Nafisa Shah requesting that the bill be revisited in the next meeting.

The committee also reviewed the imposition of a 10% GST in ex-FATA. Members were informed that two lobbies are actively working for and against the tax. Naveed Qamar noted that while the levy targets imports and exports related to industrial production, residents are objecting to being taxed on local consumption. The FBR chairman suggested providing BISP subsidies to local residents as compensation.