The benchmark index of the Pakistan Stock Exchange (PSX) saw a drop of over 200 points on Tuesday, following the negative trend in global markets in response to the U.S. announcing new tariffs on goods from Mexico, Canada, and China.

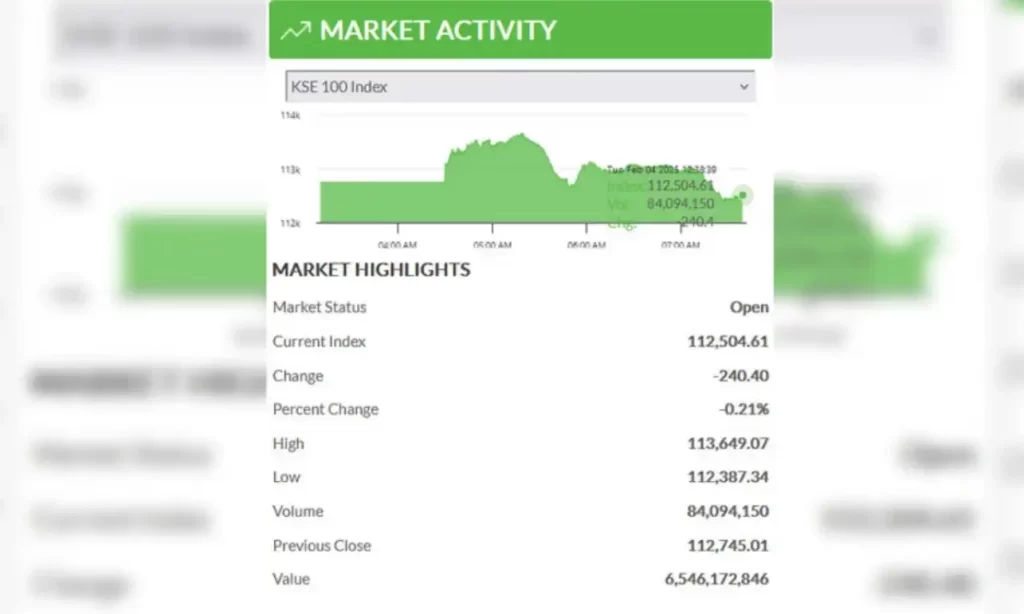

According to the PSX website, the KSE-100 index was trading at 112,504.61 levels after a gain of 240.40 points at 12:38 am.

On Monday, the KSE-100 index closed at 112,745 points, down by 1,510 points or 1.32%.

“Investor sentiment was largely influenced by growing concerns over escalating trade tensions and the potential impact on global economic stability. Consequently, the KSE-100 followed the international market’s lead, with significant losses across various sectors,” said Topline Securities.

Globally, Hong Kong shares hit two-month highs, U.S. equity futures rose, and currencies swung in big ranges as investors scrambled to keep up with sudden changes in U.S. trade policy.

S&P 500 futures were up 0.4% on Tuesday, and the dollar reversed gains on Mexico’s peso and the Canadian dollar after promises to increase border enforcement prompted U.S. President Donald Trump to suspend imminent tariffs.

Hong Kong’s Hang Seng was up 2.5%, even though an additional 10% tariff was due to hit Chinese goods from 0501 GMT, with electric vehicle makers leading the charge.

European equity futures rose by a more cautious 0.2%. Oil, which had jumped, slipped, and at $75.46, Brent crude futures were near a one-month low.

Bitcoin, which had sunk close to $91,000 a day earlier, traded around $102,000.

Australian shares advanced 0.4%, and Japanese stocks rose 1.7%, though gains were smaller than Monday’s losses as trade-war fears swept through financial markets.