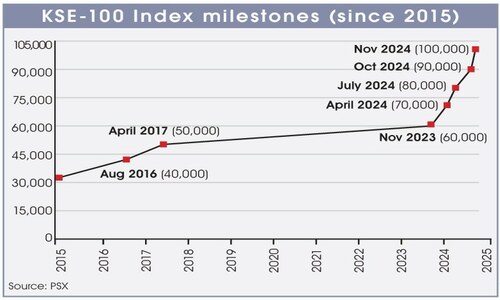

The Pakistan Stock Exchange (PSX) reached an all-time high above 100,000 points last week, as dominant bulls navigated through a volatile market amid ongoing political instability, economic concerns, and security issues.

Despite rising costs and a deteriorating law-and-order situation causing alarm among businesses and multinational companies—some of which are considering relocating abroad—the PSX demonstrated resilience. According to AKD Securities Ltd, the market remained volatile throughout the week, as political instability increased with opposition protests in the capital. This uncertainty led to a significant one-day decline in the KSE-100 index, which fell by 3,506 points on Tuesday.

However, the market regained its momentum in the following sessions as the protests in Islamabad subsided. The bull market was further fueled by a State Bank of Pakistan (SBP) circular removing the minimum deposit rate (MDR) requirement for commercial banks, financial institutions, and public sector enterprises. Consequently, the KSE-100 index saw its highest-ever single-day gain of 4,696 points on Wednesday.

Despite this, another SBP circular revising the guidelines for profit-sharing on savings deposits of Islamic Banking Institutions (IBIs) pressured Meezan Bank, leading to a loss of 439 points for the week.

Arif Habib Ltd (AHL) identified key drivers behind the recovery, including expectations of lower inflation and a strong rally in commercial banks following the removal of MDR. The week also saw the SBP raise Rs2,494bn through a T-bill auction, significantly surpassing the target of Rs800bn. This was accompanied by a decline in yields across various T-bill maturities and an increase in SBP reserves by $131 million, bringing the total to $11.4bn. The rupee depreciated slightly by 0.10% against the US dollar, closing at Rs278.04.

The market ended the week at 101,357 points, a gain of 3,559 points (3.64%) week-on-week. Positive contributions came from commercial banks, technology and communication, oil and gas exploration, marketing companies, and cement sectors. On the negative side, sectors like miscellaneous, automobile assembly, and automobile parts saw a decline.

In terms of individual stocks, Habib Bank, Bank Al-Habib, Pakistan Petroleum Ltd, Systems Ltd, and Bank Alfalah led the gains. In contrast, Meezan Bank, Engro Fertiliser, Faysal Bank, Pakistan Services Ltd, and Sazgar Engineering Works were the major decliners.

Foreign investors continued to sell, with a net outflow of $15.1 million, though this was a decrease from the previous week’s net sell of $33 million. Selling was particularly high in the banking and fertiliser sectors. On the local front, insurance companies and individual investors were net buyers, with purchases of $10.6 million and $7.3 million, respectively.

The average trading volume decreased by 1.2% to 979 million shares, while the average value traded rose by 7.1% to $133 million week-on-week.

AHL predicts that the market will continue its positive momentum in the coming week, driven by expectations of further inflation reductions. AKD Securities also believes that the ongoing monetary easing and improving macroeconomic environment will make equities more attractive, particularly given their low price-to-earnings ratio of 4.9x and dividend yield of 10.2%. With declining external financing needs under the IMF program, foreign investor interest is expected to remain strong.