On Monday, bulls maintained control over the trading floor as shares at the Pakistan Stock Exchange (PSX) rose 1,000 points in anticipation of the Monetary Policy Committee (MPC) meeting, which will take place later today.

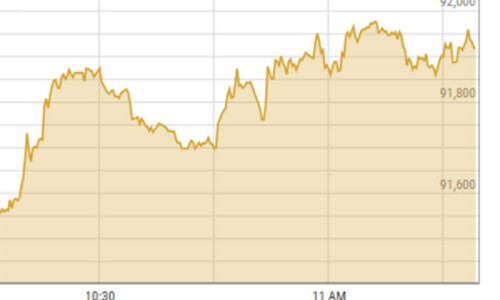

From its previous close of 90,859.85 points at 11:20am, the benchmark KSE-100 index increased 1,041.88, or 1.15 percent, to 91,901.73 points. The index ended the day at 91,938.00 points, up 1078.15, or 1.19 percent, from the previous close.

According to Sana Tawfik, head of research at Arif Habib Limited, the positive mood was brought about by the “anticipation of rate cut today” and rising macroeconomic indicators like October inflation of 7.2 percent.

She mentioned that the exploration and production (E&P) sectors were “performing because their latest financials show improved receivable collection numbers.” E&Ps are also known as E&Ps.

The bullish momentum was also attributed by Yousuf M. Farooq, director of research at Chase Securities, to “rate cut anticipation, low trade deficit, lower inflation by December, and conversion from fixed income funds.”

“Investor enthusiasm is building in anticipation of a policy rate cut in today’s Monetary Policy Committee meeting and record high exports achieved in October,” stated Awais Ashraf, director of research at AKD Securities.

He said, “Additionally, signs of improvement in the balance sheets of companies affected by circular debt for the first time in four years have further uplifted market sentiment.” He added that stocks that stand to gain from monetary easing and structural reforms are expected to perform better than others.

The MPC meeting of the State Bank of Pakistan will meet today to discuss interest rates. Because a significant rate cut is anticipated, the policy is important to economic stakeholders.

Due to lower inflation, a smaller current account deficit, and increased remittances, the majority of analysts anticipate that the central bank will cut its policy rate by 200 basis points on November 4, making it the fourth cut in a row since June.