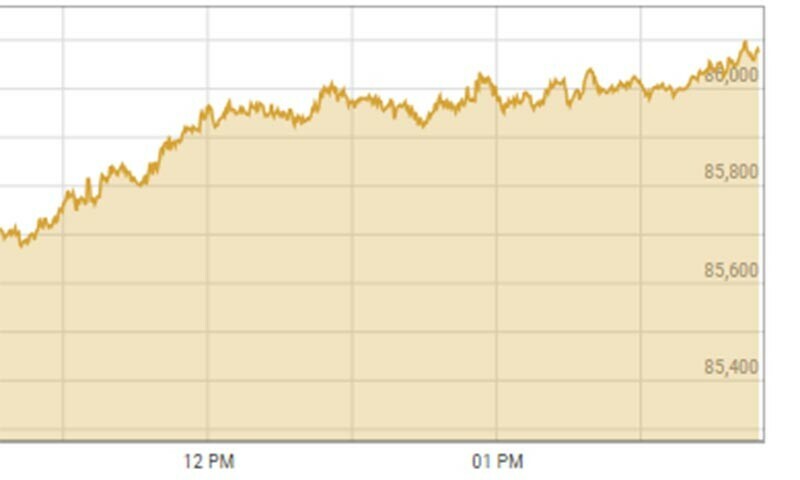

The Pakistan Stock Exchange (PSX) trade floor was dominated by bulls on Monday, as shares gained more than 800 points.

From its previous close of 85,250.09 at 1:54pm, the benchmark KSE-100 index gained 815.22 points, or 0.96 percent, to reach 86,065.31 points. At last, the record shut down at 86,057.51 places, up by 807.42 focuses or 0.95pc, from the past close.

Topline Securities CEO Mohammed Sohail credited the run to a “reduction in political noise after passing the 26th Amendment,” which helped the market make gains.

After receiving approval from both houses of Parliament, the 26th Amendment to the Constitution was enacted into law earlier today.

The much-anticipated “Constitutional Package” was finally passed by the ruling coalition with a two-thirds majority in both the Senate and the National Assembly, marking Pakistani politics’ second “working weekend” in as many months.

According to Yousuf M. Farooq, Chase Securities director of research, “The market is rerating on the back of declining interest rates.”

“Members are anticipating that political commotion should die down and financial adjustment to proceed,” he added.

“About the stability of the political system following the 26th constitutional amendment and the probable key structural reforms necessary for sustainable growth,” Awais Ashraf, director of research at AKD Securities, attributed the gains.

“The death of the 26th protected correction by parliament has eased fears of political precariousness,” he featured.

Asian markets start the week on a mixed note as traders digest China’s rate cut. Asian markets started the week on a mixed note on Monday as traders weighed the Chinese central bank’s interest rate cuts to revive the world’s second-largest economy, while gold hit a record high on geopolitical worries.

Since traders are also getting ready for the most recent earnings season for companies, another record day on Wall Street on Friday was unable to spark a rally of the same magnitude at the beginning of the week.

As part of a push by the authorities to revive spending and achieve their five percent annual economic growth goal, the People’s Bank of China stated that it had lowered two key rates to all-time lows.

The move comes after data last week showed that the economy grew at the slowest quarterly rate since the beginning of 2023, but still better than expected.