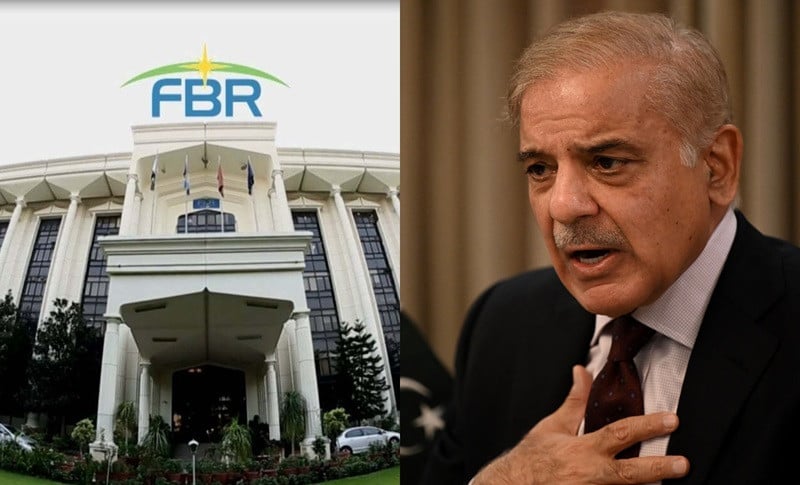

Prime Minister Shehbaz Sharif has directed the initiation of a third-party audit for all projects under the Federal Board of Revenue (FBR) to bolster transparency and operational efficiency. This instruction was given during a meeting on Friday aimed at reviewing the FBR’s operations.

The prime minister emphasized that the FBR serves as the backbone of Pakistan’s economy, highlighting the importance of its digitization as a pivotal milestone in the government’s economic reforms. He noted that improved revenue collection will enable better services for citizens and enhance the social sector.

Moreover, PM Shehbaz called for strengthening the FBR’s enforcement system, viewing it as crucial for the nation’s financial stability. He praised the FBR Transformation Plan and encouraged officials to seek feedback and recommendations from taxpayers.

Reiterating the government’s commitment to fostering a vibrant private sector, the prime minister stated that a robust private sector is essential for Pakistan’s economic future. He also urged immediate actions to combat smuggling, which he described as harmful to the economy.

The meeting featured a detailed briefing on the FBR Transformation Plan, attended by key federal ministers, including Ahsan Iqbal (Planning), Azam Nazir Tarar (Law and Justice), Ahsan Iqbal Cheema (Economic Affairs), and Muhammad Aurangzeb (Finance), along with other senior officials.

The FBR recently reported a remarkable 71% increase in tax return filers for the fiscal year 2023, adding 2.2 million filers for a total of 5.3 million. The deadline for filing income tax returns for FY24 is September 30, 2024.

In FY23, the FBR collected Rs9.285 trillion ($33.22 billion), slightly exceeding the revised target of Rs9.252 trillion, with income tax collection reaching Rs4.512 trillion—21.25% above its target. However, sales tax collection fell short, yielding Rs3.096 billion, missing its target by 14.16%.

For the first two months of the current fiscal year, the FBR collected Rs1.456 trillion, falling short of its Rs1.554 trillion target by Rs98 billion. In July, Pakistan reached a Staff-Level Agreement (SLA) with the International Monetary Fund (IMF) for a $7 billion 37-month Extended Fund Facility (EFF) to stabilize the economy.

Finance Minister Muhammad Aurangzeb has expressed aims to boost tax revenue to 15% of GDP by broadening the tax base to include the retail, export, and agricultural sectors, while also simplifying both direct and indirect taxation for a fairer system. The government has set an ambitious revenue collection target of Rs12.97 trillion for FY25, representing a 40% increase over the FY24 target.