The Container Store, a well-known retail chain specializing in storage and organizational products, is at risk of bankruptcy as it grapples with a combination of weak market conditions and intense competition. The store, which first gained attention in 2019 following the success of Netflix’s Tidying Up with Marie Kondo, saw a significant surge in sales as consumers flocked to buy organization products. Kondo’s influence led to a partnership in 2021, allowing the brand to design exclusive products with the famous decluttering expert.

However, the impact of the Kondo effect has faded, and the company’s future now hangs in the balance. A combination of factors, including a sluggish housing market and increasing competition, has strained the Container Store’s finances. Despite its growth since its founding in 1978, with around 100 locations in the U.S., the company now faces a critical period during the upcoming holiday season, which could determine its survival. Credit rating agencies have already classified the Container Store as one of the most financially distressed retailers in the market.

The challenges facing the Container Store reflect the broader retail industry, which is adjusting to a post-pandemic environment. While many retailers benefited from a surge in demand during the pandemic, the current climate is less favorable, with more store closures anticipated this year than any since 2020. In recent months, other major retailers such as LL Flooring, Big Lots, and Joann Fabric have filed for bankruptcy.

The Container Store’s struggles have become evident with a 10.5% drop in sales in its most recent quarter and a loss of $30.8 million. The company had been set to receive a financial boost from Beyond, the parent company of Bed Bath & Beyond and Overstock.com, but the deal is now in jeopardy due to difficulties in reaching agreements with its lenders.

The company’s vulnerability is partly tied to the housing market, as it relies heavily on people moving homes—typically a major driver of sales for storage and organization products. With mortgage rates remaining high, many consumers are reluctant to buy or sell homes, reducing demand for the Container Store’s products. In addition, rising interest rates and cautious consumer spending are forcing many customers to seek cheaper alternatives from competitors like Amazon, Walmart, and HomeGoods.

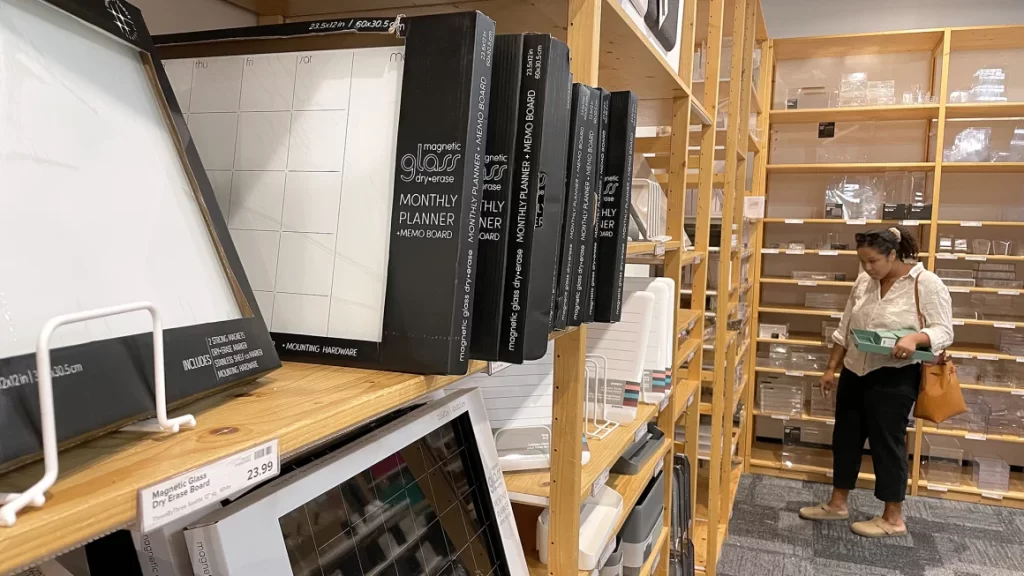

The company’s strategy of offering high-quality storage solutions and expert advice has helped it stand out in the market, but it is facing increasing difficulty competing with retailers that provide lower-priced products. With analysts predicting a lackluster holiday shopping season, the Container Store’s future remains uncertain. Moody’s Investors Service forecasts minimal growth in overall holiday sales, which could further harm companies in the home goods sector, including the Container Store.