Chancellor Olaf Scholz drives a significant level designation to New Delhi this week, wagering that more prominent admittance to the immense Indian market can lessen Germany’s dependence on Beijing regardless of whether India end up being the “new China”.

From vehicles to coordinated factors, German organizations are generally hopeful about India’s development potential, taking advantage of an abundance of talented youthful laborers, a less expensive expense base and monetary development motoring at around 7%.

The visit comes at a delicate time for Germany, whose export-oriented economy is in the midst of a second year of contraction and is concerned about a trade dispute between the European Union and China that could impact German businesses again.

Stung by its tricky dependence on modest Russian gas before the Ukraine battle in 2022, Germany has sought after a methodology of diminishing its openness to Beijing.

Economy Minister Robert Habeck stated on Wednesday that “India, the most populous country in the world, is a key partner of the German economy in the Indo-Pacific and plays a key role in the diversification of the German economy.”

German businesses and their supply chains to and from Asia must be more resilient and critical dependencies must be reduced. In any case, China is as yet the greatest show around.

According to Volker Treier, head of foreign trade at the German Chamber of Commerce DIHK, German direct investments in India were approximately 25 billion euros ($27 billion) in 2022, or roughly 20 percent of the volume invested in China. By the end of the decade, he believes that share could reach 40 percent.

“China won’t vanish, however India will turn out to be more significant for German organizations,’ said Treier.

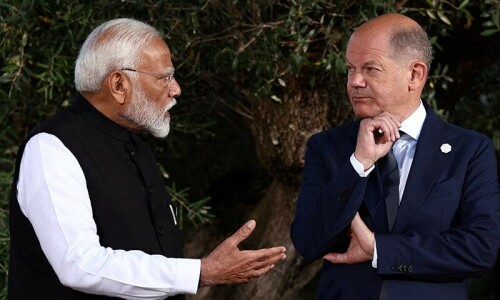

“India is the litmus test, in a manner of speaking. If de-gambling with China is to work, India is the way to it, as a result of the size of the market and the monetary dynamism in the country.” Scholz, who will take with him the greater part of his bureau including the unfamiliar and safeguard pastors, will meet Indian State head Narendra Modi on Friday prior to managing the seventh round of Indian-German government counsels.

Habeck will show up a day sooner to open the biennial Asia-Pacific Gathering of German Business.

According to a study conducted by KPMG and the German Chambers of Commerce Abroad (AHK), bureaucracy, corruption, and India’s tax system pose obstacles to investment for German businesses.

They still see a bright future in India, with 82 percent anticipating an increase in revenue over the next five years. Compared to just 36 percent in 2021, 59 percent plan to increase their investments.

For instance, German operations monster DHL plans to put a portion of a billion euros in India by 2026, taking advantage of a quickly developing online business market.

Oscar de Bok, the head of the division, stated, “We see enormous growth potential in the Asia-Pacific region, of which India has a significant share.”

Volkswagen, which has been hit by falling deals in China and high creation costs at home, is thinking about new tie-ups in India for joint creation. It has two factories and a supply agreement with Mahindra, a local partner, signed in February.

“I figure we shouldn’t underrate the likely in India regarding a market … and concerning administrative vulnerability between the US and China,” said the gathering’s money boss Arno Antlitz in May.

Likewise, Cologne-based motor creator Deutz declared an arrangement this year with India’s TAFE, the world’s third-biggest farm hauler producer, for auxiliary TAFE Engines to deliver 30,000 Deutz motors under permit.

Jonathan Brown, a managing director at BCG, stated, “The main arguments for India are political stability and low labor costs.” Therefore, you ought to implement a “China + 1” strategy in which India plays a significant role. In 2023, trade between Germany and India set a new record. By the end of the decade, India is expected to overtake Japan and Germany to become the third-largest economy in the world.

Exchanges for an EU-India deregulation bargain, years really taking shape, actually have no foreseeable endgame.

Brown of BCG stated, “The obstacles to gaining a foothold in the market are high.” However, once you get there, your potential is tremendous. What doesn’t work is simply selling German items locally.”